In the Picture

Due diligence: seller, be prepared!

November 2021Imagine…

You work as a legal counsel for an international group with several subsidiaries in Belgium.

The CFO calls to inform you that the shares of one of the Belgian subsidiaries will be sold within the framework of a restructuring of the group´s activities.

A prospective buyer has already been lined up, and its advisors would like to begin a “due diligence” within the short term. The CFO asks you to arrange things so that the process goes off without a hitch.

Where to begin?

A brief clarification.

In acquisitions, prior to the transaction, the prospective buyer conducts a business review, or “due diligence”, of the target company.

This due diligence usually entails a close examination of the target company from all relevant perspectives, including financial, technical, operational, tax and legal. In this way the prospective buyer can get a clear view of the potential risks associated with the target company. This is relevant for a possible purchase agreement, amongst other things with a view to providing for certain warranties from the seller and determining the purchase price.

Under applicable law, the responsibility for conducting an adequate due diligence generally lies firstly upon the prospective buyer, who has a pre-contractual duty of investigation. By contrast, the seller has no general obligation to proactively inform the prospective buyer about the target company. If the seller is asked for such information, however, it may not provide false information or intentionally withhold information. The prospective buyer must be able to proceed on the assumption that the information furnished by the seller is accurate and complete. If not, the seller has committed a pre-contractual fault.

A proper due diligence of the target company is thus of fundamental importance for both the prospective buyer and the seller. It allows both parties to fulfil their pre-contractual obligations and to correctly assess and limit contractual risks.

From a practical point of view, when organising a due diligence the seller must pay attention to the following points:

- Non-disclosure agreement. The information exchanged is almost always confidential, so it is important to conclude a non-disclosure agreement with the prospective buyer right at the start of the transaction process. The most recent M&A Survey confirms that such agreements are actually concluded in 66% of the cases.

- Due diligence checklist. The seller should also prepare itself for a long list of questions from the prospective buyer (“due diligence checklist”). For the legal review, the seller can already assemble the corporate documents of the target company, as well as all of the information in relation to its assets, intellectual properties, the contracts it has concluded (ranging from employment contracts through IT contracts, insurance policies and lease agreements to supply and distribution agreements), as well as information on all pending or impending litigation.

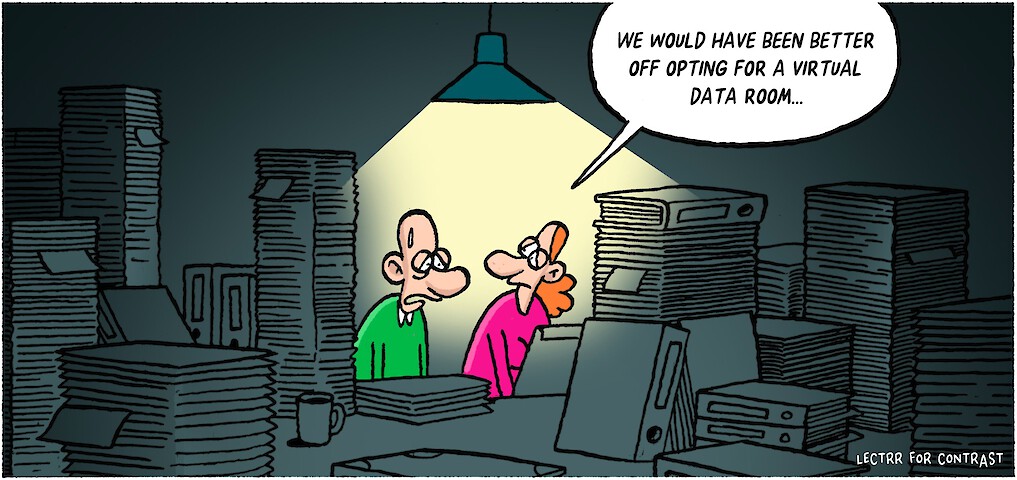

- Data room. The information is generally centralized in a “data room”. Nowadays, it has become standard practice to use a virtual data room: the M&A Survey demonstrates that a virtual data room is used in 94% of the transactions, usually set up on a specialised online platform. The advantages of a virtual data room are undeniable: large quantities of information can easily be made available and can be consulted anonymously and simultaneously with other persons.

- Q&A. According to the M&A Survey, in 78% of transactions, the parties also organise a question-and-answer (Q&A) process so that the prospective buyer can ask questions and request additional information. The seller must answer the questions diligently and fully.

- Vendor due diligence reports. Prior to the transaction, the seller itself can also conduct a due diligence of the target company and make the resulting “vendor due diligence report” available to the prospective buyer or buyers. The M&A Survey shows that “vendor due diligence reports” are often used for larger transactions (in 60% of the transactions with a deal value higher than 100 million euros).

- Competition law. The seller and prospective buyer may be competitors of one another, in which case competition law applies, which in principle prohibits competitors from exchanging competitively sensitive information with each other. If the parties are competitors, a due diligence often involves the use of a "clean team", composed of non-operational employees and outside advisors. In this way, competitively sensitive information of the seller is protected as far as possible from the prospective buyer’s operational management.

Concretely

- Although the responsibility for a due diligence in the first instance rests on the prospective buyer, the seller must make sure not to provide erroneous information or to intentionally withhold information.

- The prospective buyer can generally consult the information about the target company in a data room. Virtual data rooms have essentially replaced physical ones nowadays.

- Access to the data room is almost always made contingent on the signing of a non-disclosure agreement.

- Sellers often make use of a vendor due diligence report for larger transactions with several prospective buyers.

- The intervention of a clean team is recommended when the seller and the prospective buyer are competitors.

Want to know more?

The 5th edition of the M&A Survey of contrast analyses 446 transactions completed between 2016 and mid-2020, with a total deal value of approximately 25 billion euros. The M&A Survey was realized with the support of 88 of the most important investment companies, financial service providers, accounting firms, law firms and the Belgian Venture Capital & Private Equity Association. You can find more information about the M&A Survey here: https://www.contrast-law.be/en/publications/m-and-a-survey/.

And you can find more information about share purchase agreements under Belgian law in this book: https://www.contrast-law.be/en/publications/books/share-purchase-agreements-belgian-law-and-practice/.

Please consult our website or contact one of our team members if you have questions or require more information: