In the Picture

Safety first! Screening of foreign direct investments in Belgium

June 2024Imagine...

You are a member of the management team of a Belgian Internet provider. Your company wants to roll out a state-of-the-art mobile network in Belgium and is looking for capital to do so. The search for suitable investors goes smoothly and an agreement in principle is reached relatively quickly with an American telecom juggernaut to acquire a 32% stake in the company.

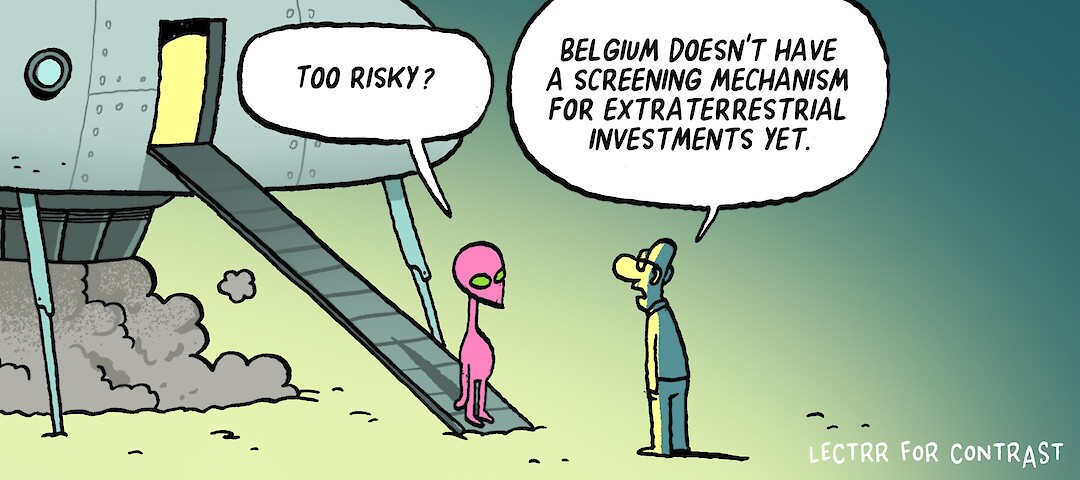

You are on cloud nine. Since the investor is not acquiring control, there is no merger control required and nothing seems to stand in the way of the rapid implementation of the investment. Yet you have heard talks about screening regimes for foreign investments in EU Member States, including Belgium. Surely this investment does not fall under such a regime? Or does it?

A brief clarification.

You may recognise the situation above, which we previously described in our In The Picture of September 2022 about the EU regulation on foreign direct investment screening. This regulation did not introduce an EU screening mechanism but set up a framework for screening foreign direct investment at the level of EU Member States. This screening framework aims to protect national security and public order by controlling the acquisition of interests in strategic EU companies by investors from non-EU countries.

Belgium introduced a Foreign Direct Investment (“FDI”) screening mechanism based on the EU regulation just under a year ago. The main points of the screening are as follows.

Foreign investors – individuals and companies from non-EU countries or European companies with ultimate beneficial owners ("UBOs") in third countries must notify investments in existing Belgian companies in strategic sectors to the Interfederal Screening Commission ("ISC"). These sectors are broadly defined and include defence, energy, cybersecurity, critical infrastructure, essential technologies and raw materials, as well as sectors with access to sensitive information or personal data.

The notification obligation is triggered when foreign investments result in the direct or indirect acquisition of control, or of 25% or 10% of voting rights depending on the sector. The FDI screening mechanism also has a broad application in this respect. For instance, the 25% threshold is reached cumulatively, for example, if a 20% investor acquires a further 5% of voting rights. Moreover, intragroup restructurings or expansions of veto rights can also trigger the notification obligation. This means that in our example of the Internet provider, a notification by the American investor is required, as it concerns an acquisition of more than 25% in electronic communications.

The notification and approval must take place before the completion of the transaction. Thus, a standstill obligation applies. It is possible to notify on the basis of a draft agreement, but the final agreement must not differ significantly from the draft.

As with merger control, notification to the ISC involves an extensive submission of information. Three different notification forms must be submitted: (i) the Belgian notification form, (ii) the summary, and (iii) the EU form. There are no notification fees associated with an FDI filing (no “filing fee”).

Once the ISC considers the notification complete, which usually takes one to two days, the procedure goes through either one or two phases:

- Phase 1 – assessment procedure. During this phase, it is examined whether the investment could affect public order, national security or strategic interests. If there are no indications to that effect, an approval decision follows. In principle, the assessment procedure takes 30 days, but can be extended, for example, pending responses to requests for information.

- Phase 2 – screening procedure. If there are indications of an impact on public order, national security or strategic interests, the ISC conducts a screening during a renewable 20-day period that culminates in an advice. Based on the advice, including the possible reaction of the companies concerned to the draft advice, a decision follows within 8 days. Only the parties concerned can appeal the decision before the Market Court in Brussels.

According to the ISC's most recent data, only 3 notifications out of 46 were referred to the screening procedure.

During the screening procedure, the parties may propose remedies to address concerns, ranging from "soft" measures, such as protocols for handling sensitive information or the appointment of a compliance officer, to more invasive structural measures, such as a "carve-out" of parts of the target.

The foreign investor bears full responsibility for the notification. All fines related to non-compliance with the notification obligation, the provision of incomplete or incorrect information during the procedure, or non-compliance with the standstill obligation are borne solely by the foreign investor. This is the case even if the cause lies with the target or the sellers. In some cases, the fines can amount to 30% of the value of the investment related to the Belgian activities. This is an important consideration when drafting transaction documents.

Concretely.

- Belgium has introduced a uniform screening mechanism for FDI, effective July 1, 2023.

- The scope of the FDI screening mechanism covers a broad range of strategic sectors, including defence, energy, cybersecurity, critical infrastructure, essential technologies and raw materials, as well as sectors with access to sensitive information or personal data.

- The FDI screening mechanism applies to non-EU investments that lead to the direct or indirect acquisition of control or respectively 10% or 25% of the voting rights in existing Belgian companies. The voting rights thresholds are calculated cumulatively.

- The foreign investor is subject to a notification obligation. Implementation of the transaction must be suspended until approval is obtained ("standstill obligation"). Failure to follow these obligations can result in fines.

- The procedure can be time-consuming and unpredictable. The assessment procedure can take up to 30 days. If a more thorough investigation is needed (the "screening procedure"), this period is extended by at least 28 days. More extensions and suspensions are possible and do occur in practice.

- Parties may propose remedies to address any concerns about the investment.

Want to know more?

- The FDI screening mechanism is based on Regulation (EU) 2019/452 of the European Parliament and of the Council of March 19, 2019 establishing a framework for the screening of foreign direct investment into the Union. On that, see also our earlier In The Picture: Safety First! Screening of Foreign Direct Investment in the European Union.

- The cooperation agreement as the basis for the Belgian FDI screening mechanism can be found here, and more information here.

Please consult our website or contact one of our team members if you have questions or require more information: